Procure-to-Pay Process

What is Procure-to-Pay?

An organisation obtains the items and services it needs to operate through the procure-to-pay procedure, also known as procure-to-pay. It begins with locating suppliers to purchase these goods and services from and concludes with paying for them, as the name would imply.

To guarantee that all purchases are obtained, approved, and paid for properly, an organization’s end-to-end process involves several individuals from various departments. Procurement, purchasing, accounts payable, operations, and of course any teams that have to make purchases, are teams that are involved in this process.

Procure-to-pay software is widely used by businesses to streamline and improve operations. The management of purchasing, cash flow, accounts payable, and supplier relationships may all be done effectively using these technologies.

Additionally, by reducing unnecessary spending, they assist organisations in improving their bottom lines by automatically enforcing procurement standards.

What Are the Procure-to-Pay Cycle’s Important Phases?

The procure-to-pay cycle’s essential phases include purchasing, receiving, and accounts payable. It’s crucial to take a broad look and comprehend what occurs at each of these crucial stages before we go into the precise processes of the procure-to-pay process.

There are four main processes that make up the procure-to-pay (P2P) cycle stages:

The Procurement Process

- Purchase orders are made outlining the products or services required.

- Procurement teams look for and evaluate suppliers.

- In order to guarantee fair pricing and great quality, market research is carried out.

- Supplier ties are created.

- A sustainable supply chain is built and supplier agreements and payment schedules are formed.

The Buying Procedure

- Suppliers with prior approval are considered and chosen.

- Orders for goods are sent out.

- Purchase orders are approved by suppliers, and they consent to fill the order.

The Buying Procedure

- Receiving documents are logged as goods and services are received or performed.

- In order to ensure quality, goods or services are assessed.

- For further evaluation, damaged goods or poor services are marked.

- Quality and on-time delivery metrics are tracked for future supplier performance reports.

The process of paying bills

- After being received, invoices go through an approval process.

- Reconciliation and cross-checking of invoices with the original PO, receipts, or receiving papers are performed (three-way matching).

- Errors are tracked and fixed.

- The payment of approved invoices.

Better efficiency and cost savings can be achieved by eliminating manual operations (such as signing buy requisitions by hand, matching paper receipts with purchase orders, etc.) during the critical phases of the procure-to-pay cycle.

Let’s examine the P2P processes in more detail now that the essential stages have been identified.

How Does the Procure-to-Pay Process Work?

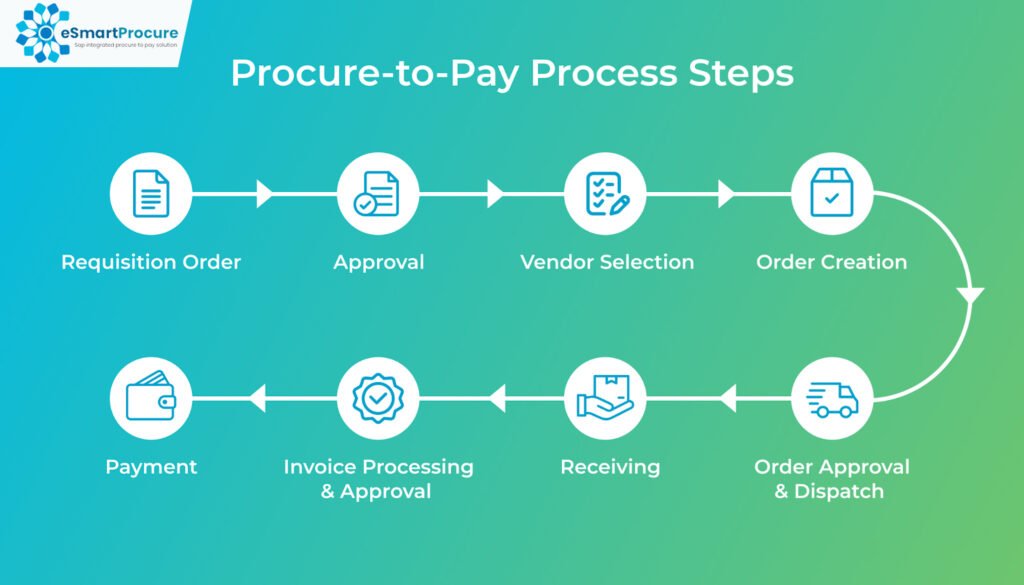

The procure-to-pay procedure consists of the nine steps listed below. This section will outline each stage in detail and offer some advice on how to speed up the procedure.

Created a Purchase Requisition

Internal requests for authorization to make purchases are known as purchase requisitions. Requisitions can be submitted on paper or through software for purchasing, where the right approvers are selected automatically.

While many requests for common items are easily accepted, businesses still need to leave money in their budgets for unanticipated costs.

Vendor Selection

The vendor will probably already be chosen from a preferred vendor list for routine purchases. A vendor selection procedure is started for fresh orders.

The procurement department may either do a rapid review of a small list of pre-approved vendors or issue a request for proposals (RFP) specifying the specifications.

Suppliers submit a bid in response to an RFP that includes information about the project’s turnaround time, cost, and material requirements. The following criteria are taken into account by procurement teams, and they may even be negotiated with vendors:

- Quality

- Prices and delivery times

- Price drop throughout the past year

- Quantity reductions

- Future quality improvements

- Costs of shipping and insurance

It may also be important to follow applicable laws and environmental, social, and governmental (ESG) norms.

Approval of a purchase order (PO)

Managers and purchasing teams must approve the purchase order after the vendor has been chosen.

This calls for the appropriate approvers to physically or digitally stamp the document. In an automated system, POs are swiftly approved electronically after being automatically sent to the appropriate approver. So, the process for creating a purchase order starts after approval is complete.

Issue of a Purchase Order (PO)

The purchasing team now draughts a purchase order with all the details the vendor will require to complete the order. So, the PO becomes a legally enforceable contract after the vendor gets it and formally accepts it, stipulating that the vendor will provide the requested products or services and the buyer will pay for them as agreed upon.

Getting Logged Documents

The procurement system receives the provided products or services from the vendor, and the pertinent receiving document (often a goods receipt or packing slip) is recorded with line items checked to make sure that everything ordered was delivered.

Bill received

The buyer’s accounts payable system receives an invoice from the vendor, which is then entered. Through the use of vendor portals, automated systems frequently facilitate electronic invoicing (eInvoicing).

Processing and reconciliation of invoices

The PO and the receiving document (receipt or packing slip) are compared to the invoice. In automated systems, the three-way matching process verifies that the goods were delivered and billed as ordered by comparing the invoice with the receiving document and purchase order. Unmatched line items are noted and submitted for further inquiry.

Approval of Invoices

The accounts payable team must approve the invoice before it can be paid once it has been verified that it corresponds with the receiving papers and the PO. The receipt and quality of the items or services may need to be double-checked with the buyers, although three-way matching by itself is frequently sufficient for AP teams to approve routine invoices.

Payment

The buyer’s finance department sends invoices that have been accepted for payment to accounts payable (AP). Basically, payment requirements with vendors are met, and the accounting system is updated to show that the order has been paid.

What Distinguishes AP from P2P (Procure-to-Pay)?

The procure-to-pay (P2P) procedure and the accounts payable (AP) process are not the same. Instead, the buyer pays the invoice during the P2P process’s final stage, known as AP.

It starts when the invoice is received and concludes when it is paid. Moreover, the complete purchasing and payment procedure, from the purchase request through payment, is referred to as the P2P process.

Receiving the invoice, entering the data, verifying its accuracy, and authorising it are all steps in the account payable process. After that, the invoice is paid using the vendor’s preferred payment method.

How Can the Procure-to-Pay Process Be Managed Better?

Certainly, for any company wishing to automate procure-to-pay processes and improve procurement management, dedicated procure-to-pay solutions are the ideal choice.

Traditionally, manual and paper-based processes have been used to complete many stages of the procure-to-pay process. Manual processes take far longer to complete than automated ones for tasks like invoice reconciliation, purchase order generation, and approval routing and signatures.

Organisations can save a substantial amount of time and money by automating these operations. However, each step of the procure-to-pay process can be partially or completely automated with the help of software.

What Advantages Do Procure-to-Pay Software Offer?

Using a procure-to-pay method has many advantages. Of course, the two main advantages are cost and process efficiency. Levvel Research discovered that using procurement software slashed lifecycle times for processing invoices, purchase orders, and other P2P activities by 56% as compared to traditional methods.

By promoting communication and openness between procurement, accounts payable, and suppliers, procurement software offers several advantages. These advantages consist of:

Processes that are centralised and streamlined

With options like automatic routing, alarms, contingencies, and automatic invoice matching, a centralised system eliminates silos and streamlines the purchase order and invoicing cycles.

Integration to Current Systems

Accounting software and enterprise resource planning (ERP) systems can both be integrated with software solutions. So, this combines data and processes for simpler stakeholder and buyer collaboration.

Automation

Automation solutions speed up workflows, remove time-consuming manual chores, and free up workers to concentrate on high-value jobs by removing human error and inefficiency.

More effective vendor management

An organisation can enhance vendor management and partnerships by utilising more real-time reporting, centralised contract administration, and transparent data.

Spending Control

Invoice inconsistencies, maverick spending, invoice fraud, duplicate payments, and late fees are all reduced or eliminated in a closed buying environment.

More Discounts

Faster payments enable the accounts payable staff to benefit from additional early-payment discounts.

A value-driver is procure-to-pay

Any organisation may improve its spending management when the procure-to-pay process is carried out with the appropriate instruments, and software unquestionably helps.

However, the tools that procurement and AP teams require to analyse and improve workflow efficiency, vendor management, and spending can help them establish a P2P cycle that improves quality, efficiency, and long-term sustainability for their company.